Samco Mutual Fund received SEBI's final approval on July 30, 2021, for setting up a mutual fund business in India. Thus, it launched its first NFO in January 2022. It has a continuously growing family of over 24,000+ partners. Samco Mutual Fund was a trust on August 06, 2020, with Samco Securities Limited as the Sponsor and Samco Trustee Private Limited as the Trustee. The total AUM of the Fund House as of the last day of the Quarter, i.e., 31 December 2024, is Rs. 305,449.57 Lakhs, while the Average AUM for the Quarter is Rs. 275,917.82 Lakhs.

History of Samco Group

Samco Group has been in the capital markets since 1993 under the Samruddhi Stock Brokers brand name. In 2015, under the leadership of Mr. Jimeet Modi, Samruddhi Stock Brokers was rebranded as Samco Securities. Samco Group is involved in multiple businesses, including Stock Brokerage, Mutual Fund Distribution, Advisory, Asset Management, and capital Market Lending.

Key Information About Samco Mutual Fund

How to Invest in the Samco Mutual Fund

Investing in the best Samco Mutual Funds can be a complex process. To make it easier, here is a step-by-step guide:

1. Choose Your Mutual Fund Type

Choose your mutual types, such as equity, debt, hybrid, index, and sector funds, according to your risk tolerance (low, medium, or high) and financial goals.

2. Select a Mutual Fund Scheme

After carefully analysing the historical returns, expense ratio, reviews, and ratings of different schemes, choose your preferred Samco Mutual Fund.

3. Login or Open a Demat Account

Log in to your Stack Wealth account. If you do not have an account, you can register with your mobile number and create a new one immediately.

4. Complete KYC (Know Your Customer) Requirements

The next step involves providing personal information and verifying identity. You must upload a government-issued ID such as PAN, Aadhar and proof of address. Follow the instructions in the app to complete this step smoothly.

5. Select Investment Mode (SIP or lumpsum)

If you prefer regular, disciplined investing, you can set-up a systematic investment plan (SIP), which is periodic (monthly, quarterly, etc.). You can also make a lump-sum investment if you have a large amount to invest. Select the investment period of your choice.

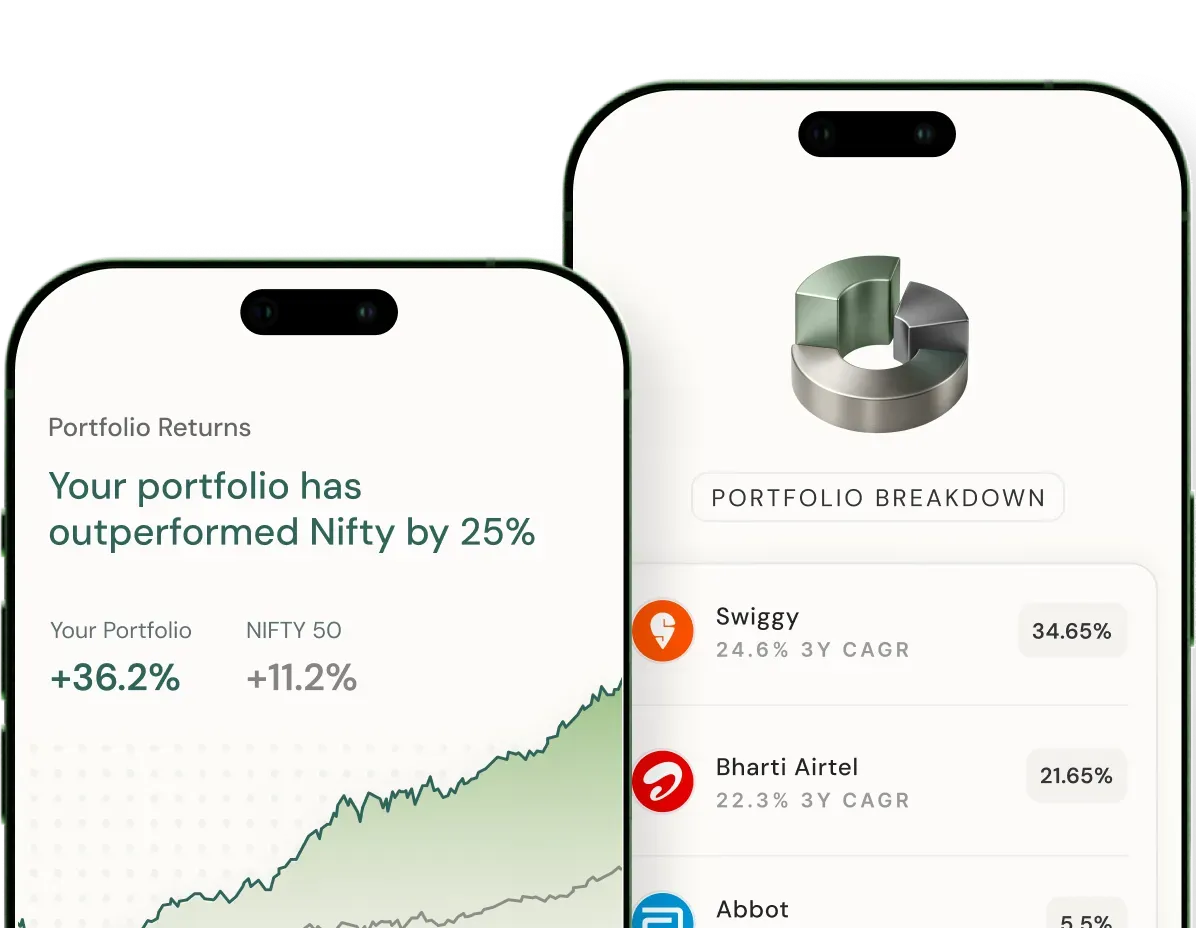

6. Confirm and Track Your Investment

After setting up your investment, sit back and watch your money grow. The Stack Wealth app will provide regular updates and reports on your portfolio’s performance. You can also adjust your investments or withdraw funds as needed.

List of Best Samco Mutual Funds in India

Here is the list of some of the best Samco Mutual Funds in India:

* All data as of 28 Feb 2025

Detailed Overview of Samco Mutual Fund Schemes

Now, let’s discuss these 10 Samco Mutual Fund schemes in detail:

1. Samco Multi Cap Fund - Direct Plan-Growth

Samco Multi Cap Fund is an open-ended scheme that allocates 25% of its assets to large, Mid-cap, Small, and small-cap companies outside the NIFTY 500.

- Benchmark Index: Nifty 500 Multicap 50:25:25 Total Returns Index

- Minimum Investment Amount: The minimum lump sum for the Samco Multi Cap Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

2. Samco Special Opportunities Fund - Direct Plan-Growth

Samco Special Opportunities Fund is an open-ended equity scheme that follows a theme of special situations by investing in a portfolio of securities that are engaged in special situations such as turnarounds, spin-offs, restructurings, mergers & acquisitions, new trends, new & emerging sectors, digitisation, premiumisation, and other extraordinary corporate actions.

- Benchmark Index: NIFTY 500 TRI

- Minimum Investment Amount: The minimum lump sum for the Samco Special Opportunities Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

3. Samco Overnight Fund - Direct Plan-Growth

Samco Overnight Fund is a debt scheme that invests in overnight securities with a relatively low interest rate and low credit risk. It is a open-ended scheme.

- Benchmark Index: CRISIL Liquid Overnight Index

- Minimum Investment Amount: The minimum lump sum for the Samco Overnight Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

4. Samco Multi Asset Allocation Fund - Direct Plan-Growth

Samco Multi Asset Allocation Fund is an open-ended scheme that invests in Equity, Fixed Income, Exchange Traded Commodity Derivatives / Units of Gold ETFs / Silver ETFs & REITs/InvITs.

- Benchmark index: 65% Nifty 50 TRI + 20% CRISIL Short Term Bond Fund Index + 10% Domestic Price of Gold + 5% Domestic Price of Silver

- Minimum Investment Amount: The minimum lump sum for the Samco Multi Asset Allocation Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

5. Samco Flexi Cap Fund - Direct Plan-Growth

Samco Flexi Cap Fund is an open-ended dynamic equity scheme that targets to generate long-term capital growth from an actively handled portfolio of Indian & foreign equity instruments across market capitalisation.

- Benchmark Index: Nifty 500 Index TRI

- Minimum Investment Amount: The minimum lump sum for the Samco Flexi Cap Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

6. Samco Active Momentum Fund - Direct Plan-Growth

Samco Active Momentum Fund is an equity scheme based on the momentum theme. Its investment aim is to generate long-term capital appreciation by investing in stocks with strong momentum.

- Benchmark Index: Nifty 500 TRI

- Minimum Investment Amount: The minimum lump sum for the Samco Active Momentum Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

7. Samco Arbitrage Fund - Direct Plan-Growth

Samco Arbitrage Fund is an open-ended scheme that invests in arbitrage opportunities in the equity markets' cash and derivative segments, within the derivative segment, and the rest in debt and money market securities.

- Benchmark Index: Nifty 50 Arbitrage TRI

- Minimum Investment Amount: The minimum lump sum for the Samco Arbitrage Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

8. Samco ELSS Tax Saver Fund - Direct Plan-Growth

Samco ELSS Tax Saver Fund is an Equity Linked Saving Scheme with a statutory lock-in of 3 years. Its goal is to provide a potential return on investing in high-quality mid and small companies with the benefit of tax savings.

- Benchmark Index: Nifty 500 TRI

- Minimum Investment Amount: The minimum lump sum for the Samco ELSS Tax Saver Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

9. Samco Large Cap Fund - Direct Plan-Growth

Samco Large Cap Fund is an open-ended equity scheme primarily investing in equity and equity-related instruments of large-cap companies. The scheme's investment objective is to generate long-term capital appreciation from a diversified portfolio.

- Benchmark Index: NIFTY 100 Total Returns Index

- Minimum Investment Amount: The minimum lump sum for the Samco Large Cap Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

10. Samco Dynamic Asset Allocation Fund - Direct Plan-Growth

Samco Dynamic Asset Allocation Fund is a dynamic asset allocation fund. The scheme aims to generate income or long-term wealth appreciation by investing in equity, equity derivatives, fixed-income instruments, and foreign securities.

- Benchmark Index: NIFTY 50 Hybrid Composite Debt 50:50 Index

- Minimum Investment Amount: The minimum lump sum for the Samco Dynamic Asset Allocation Fund is ₹5000; for Min Add Lumpsum, it is ₹500; for SIP, it is ₹500.

Top Fund Managers

Below is the list of people who have made Samco Mutual Fund Investment a standout choice in a highly competitive market.

1. Mr. Umesh Kumar Mehta

Mr. Umeshkumar Mehta is the Executive Director, CIO, and fund Manager at Samco AMC. He has over 25 years of experience in Indian Capital Markets, oversees investment strategies, and manages assets across diverse portfolios. Mr. Mehta used to lead the Samco group’s Research team and has been involved with the group for the last fifteen years.

2. Mrs. Nirali Bhansali

Nirali Bhansali is a fund manager at Samco AMC. She has around 8 years of experience, with over 6 in capital markets and investment research. Her deep understanding of fundamental analysis has enabled her to provide cutting-edge insights in conceptualising and developing Samco's flagship research and Investment products.

3. Mr. Dhawal G Dhanani

Dhawal Ghanshyam Dhanani has over five years of experience advising international clients on taxing transactions and capital markets. He has also worked as an equity research analyst, where he was instrumental in creating insightful investment strategies. He has garnered a deep understanding of financial statements and is currently a fund manager at Samco AMC.